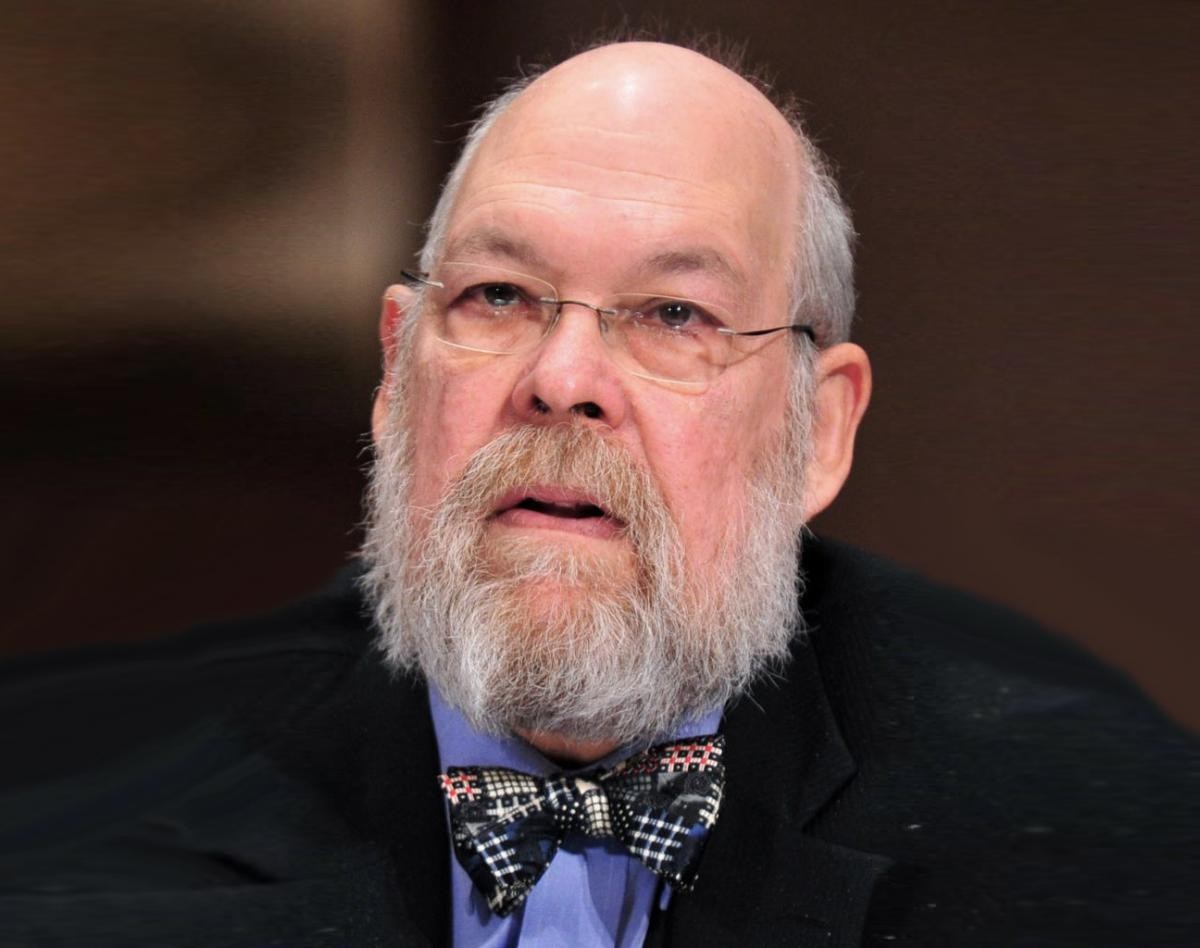

5 Questions: Tax Policy Expert Michael Graetz on Reforming Our System

Politicians have been talking about the need for tax reform for decades and this year’s presidential campaign is no exception. Hillary Clinton and Donald J. Trump both say changes are needed, but it should come as no surprise that their proposals are very different.

Michael J. Graetz, the Columbia Alumni Professor of Tax Law at the Law School and a recognized expert on taxation, has analyzed both candidates’ proposals. “Donald Trump’s proposals are unrealistic and Hillary Clinton’s are ineffective,” he says.

Graetz, who came to Columbia in 2009, was assistant to the secretary and special counsel for the U.S. Department of the Treasury in 1992 and deputy assistant secretary for tax policy in 1990 and 1991. He has testified before Congress many times and is the author of several books, including 100 Million Unnecessary Returns: A Simple, Fair and Competitive Tax Plan for the United States.

Q. Why do we need tax reform?

A. We have the highest corporate income tax rate in the industrialized world, 35 percent. It is true that few U.S. corporations pay that maximum rate, but the statutory rate matters. It encourages companies to take deductions here and book income somewhere else. The system was designed for the economy of a century ago. The individual income tax is broken for different reasons. Both Democrats and Republicans have agreed over the years that tax breaks are the solution to all the country’s social and economic issues. If you want home ownership, for example, you create a mortgage deduction. Congress and the presidents have been using the income tax the way my mother used chicken soup, as a cure-all for every problem. That has created a robust tax-preparer industry.

Q. How are the two major party candidates addressing these issues?

A. Trump would lower the corporate tax rate and the business rate more generally to 15 percent, but he doesn’t tell us how he would make up the lost revenue. For the individual income tax, he has proposed three brackets at lower rates, with a 25 percent rate at the top. His proposals would do nothing about the problem of deductions and tax breaks.

Clinton has been attentive to the budgetary effects of her proposals. Her top individual income tax rate would be 44 percent on income over $5 million. She also would raise capital gains taxes, which Trump would not. She tries to address some of the international issues in corporate taxation by imposing an exit tax on U.S. companies that move their headquarters to a foreign location. She has a proposal to limit the ability of U.S. companies to reduce taxes through interest and royalty deductions. But she doesn’t make any change in the corporate rate. She is plugging gaps one at a time. Many of her proposals are old hat and unlikely to be enacted.

Q. What about the estate tax?

A. It is easily the most progressive tax we have. To pay it at all you have to have an estate of about $11 million for a couple, although states may have lower exemptions. Very few people have to pay it. But if you look at polling data, the majority of the American people would like to repeal the estate tax. Trump says he would repeal the estate tax, the same position every Republican running at least in this century has taken. Hillary Clinton would like to lower the amount exempt from taxation and increase the rates. But one thing you can be sure of, whether you have a Republican or Democratic House and Senate they’re not going to lower the exemption. Opponents of the estate tax have a very powerful lobby, it’s really a model for how to oppose taxes and tax increases.

Q. What do you think is needed?

A. I have long advocated a tax on consumption, a value-added tax, which is more conducive to economic growth. It doesn’t tax savings, which allows for accumulation of capital over time. It is easier to administer and harder to evade. But you have to solve the regressive part, lower and middle-income people consume more of their income. I would eliminate some payroll taxes for the workers at the bottom, increase some benefits for families with children, and impose income taxes on high incomes that would be lower than the current income tax rates. My proposal has been scored as revenue and distributionally neutral by the non-partisan Tax Policy Center.

Q. Your most recent book was about the Supreme Court. How did 'The Burger Court and the Rise of the Judicial Right' come about?

A. The story of the Burger Court was that nothing happened between the liberal Warren Court, which ended in 1969, and the conservative Rehnquist and Roberts courts that started in 1986. But the Court doesn’t sit in its marble building in Washington, D.C., totally unaffected by social and political change. Richard Nixon had four appointments by 1971. The Burger Court had a long legacy and a long reach. Citizens United, for example, one of the most famous decisions of the Roberts court, was built on two cases of the Burger Court. Other decisions affected school funding and remedies for segregation. It was a very influential court.